China’s economy slows in May, more stimulus expected

By Reuters

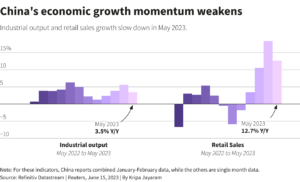

Beijing, June 15: China’s economy stumbled in May with industrial output and retail sales growth missing forecasts, adding to expectations that Beijing will need to do more to shore up a shaky post-pandemic recovery.

The economic rebound seen earlier this year has lost momentum in the second quarter, prompting China’s central bank to cut some key interest rates this week for the first time in nearly a year, with expectations of more to come.

“The post-Covid recovery appears to have run its course, an economic double dip is nearly confirmed, and we now see significant downside risks to our below-consensus GDP growth forecasts of 5.5% and 4.2% for 2023 and 2024, respectively,” analysts at Nomura said in a research note after the latest disappointing data.

Industrial output grew 3.5% in May from a year earlier, the National Bureau of Statistics (NBS) said on Thursday, slowing from the 5.6% expansion in April and slightly below a 3.6% increase expected by analysts in a Reuters poll, as manufacturers struggle with weak demand at home and abroad.

Retail sales – a key gauge of consumer confidence – rose 12.7%, missing forecasts of 13.6% growth and slowing from April’s 18.4%.

Data ranging from factory surveys and trade to loan growth and home sales have shown signs of weakness in the world’s second-biggest economy. Crude steel output extended both year-on-year and month-on-month falls in May while daily coal output fell from April too, NBS figures showed.

The soft run of data has defied analysts’ expectations for a sharper pickup, given comparisons with last year’s very weak performance, when many cities were under strict COVID lockdowns.

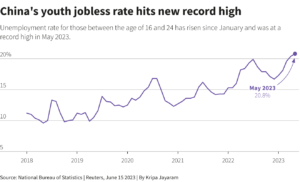

Analysts say the figures also reinforce the case that more stimulus is needed as China faces deflationary risks, mounting local government debts, record youth unemployment and weakening global demand.

“Insufficient domestic demand and sluggish external demand could interrupt the momentum in the ongoing months, leaving China with a more gradual U-shape recovery trajectory on its month-on-month growth path,” said Bruce Pang, chief economist at Jones Lang LaSalle.

Introducing stimulus with large-scale policy easing would be the first step, Pang said. “But it could need two to three years to shore up a slowing economic recovery.”

Following the downbeat data, JP Morgan trimmed its forecast for China’s 2023 full-year gross domestic product (GDP) growth to 5.5% from 5.9%. The government has set a modest GDP growth target of around 5% for this year, after badly missing the 2022 goal.

CENTRAL BANK EASING

China’s central bank on Thursday cut the interest rate on its one-year medium-term lending facility, the first such easing in 10 months, paving the way for cuts in the benchmark loan prime rates (LPR) next week. The move was expected after it trimmed some short-term rates earlier in the week.

The yuan hit a fresh six-month low after the rate cut and China’s stock markets rose, with the benchmark CSI 300 (.CSI300) gaining 1.6% and Hong Kong’s Hang Seng Index (.HSI) climbing 2.2%.

Markets are also betting on more stimulus, including measures targeting the floundering property sector, once a key driver of growth.

While policymakers in Beijing have been cautious about deploying aggressive stimulus that could heighten capital flight risks, analysts say more easing will be needed.

The country’s biggest banks recently cut their deposit rates to ease pressure on profit margins and encourage savers to spend more.

Julian Evans-Pritchard, head of China at Capital Economics, said while the central bank’s easing won’t make much difference on its own, it reveals “growing concerns among officials about the health of China’s recovery.”

He added the second quarter is shaping up to be weaker than he had anticipated and further policy support is probably needed to prevent the economy from entering a renewed downturn.

NBS spokesperson Fu Linghui told a press briefing that second quarter growth was expected to pick up due to last year’s low base effect.

However, he warned the recovery faces challenges including “a complicated and grim international environment, sluggish global economic recovery” and well as “insufficient domestic demand”.

Yi Gang, PBOC governor, pledged last week that China will make counter-cyclical policy adjustments to shore up the economy.

Property investment in May fell at the fastest pace since at least 2001, down 21.5% year-on-year, while new home price growth slowed.

The property sector, historically a major driver of China’s economic activity, is expected to grapple with “persistent weakness” for years, Goldman Sachs analysts said this week.

Private fixed-asset investment shrank 0.1% in the first five months, a sharp contrast to the 8.4% growth in investment by state entities, suggesting weak business confidence.

Labour market pains continued with youth unemployment jumping to a record 20.8%. The nationwide survey-based jobless rate stayed at 5.2% in May.

Strikes at Chinese factories have surged to a seven-year high and are expected to become more frequent as weak global demand forces exporters to cut workers’ pay and shut down plants, one rights group and economists said, further hurting consumer and business confidence.

Courtesy: Reuters