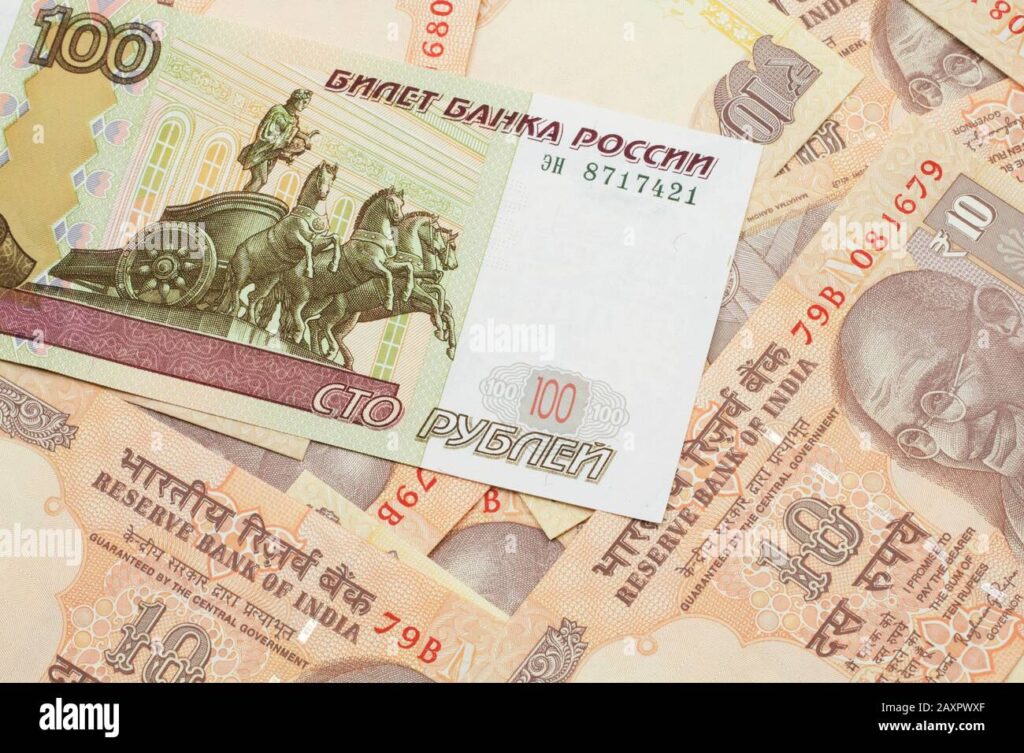

India Russia explore Rupee-Ruble Trade

India and Russia are exploring a rupee-rouble rate to overcome dollar trade barriers in the wake of US sanctions on Moscow, according to The Economic Times report.

This would be a welcome development since Russia has accumulated a significant amount in rupees while trading with India.

At least since the outbreak of the Ukraine war in February 2022, in order to avoid the sanctions imposed on Russia’s international trade and ouster from SWIFT banking system, billions of dollars worth of rupees have accumulated in Indian banks favouring Russia, even as India accelerated it’s oil imports from Russia.

Currently, banks handling export-import payments or any capital flows between the two countries have to take the dollar route in converting the currencies. This means carrying out two, almost simultaneous, transactions – of rupee to US dollar, and dollars to rouble – in arriving at a rupee-rouble exchange rate.

RBI deputy governor T Rabi Sankar and top officials of some public sector banks will be visiting Moscow for a meeting of the India-Russia Joint Business Council for banking and finance. They are likely to discuss this as well as a payment confirmation mechanism.

Russian financial institutions sounded out the RBI on a mechanism to let them use rupees lying in special Vostro accounts in India for investment in stocks and securities in India.

If RBI approval comes through, the fund could invest the amount in securities listed on Indian exchanges and transfer equivalent amounts in roubles to Russian companies that have exported to India but have not accepted payments in rupees.

India and Russia will also be exploring other payment options, like the India-UAE trade mechanism. Under the India-UAE system, exporters and importers from both countries invoice trades and make payments in rupee or dirham while the central banks agree to accept the foreign currency for the domestic one.